A bumpy road towards a brighter outlook, May’s retail round up

)

Headline inflation eased to 8.7% in April, down from March's 10.1%, but remained higher than forecasts by economists and the Bank of England, at 8.2% and 8.4% respectively (ONS). However, core inflation and food prices have proven more resilient than expected, leading to a prolonged period of elevated inflation and continued pressure on disposable incomes.

The Bank of England now predicts overall inflation to reach 5% by the end of the year, surpassing the previous forecast of 4%. As a result of the increase in interest rates, households can expect higher mortgage, credit card, and loan repayments, while saving becomes more incentivised over discretionary spending.

Concerns over mortgage costs are escalating, with interest rates reaching 4.5% in May, the highest level since 2008. With approximately 85% of mortgages being fixed-rate, around 1.3 million households are projected to face monthly increases of up to £200 as their deals expire this year, based on current rates. When factoring in households on variable and tracker rates (who face immediate increases in repayments in line with the bank rate), over 3 million UK households are likely to experience significant mortgage pressures over the year ahead. Additionally, the rise in mortgage costs is expected to have a ripple effect on rent prices as landlords pass on these higher expenses.

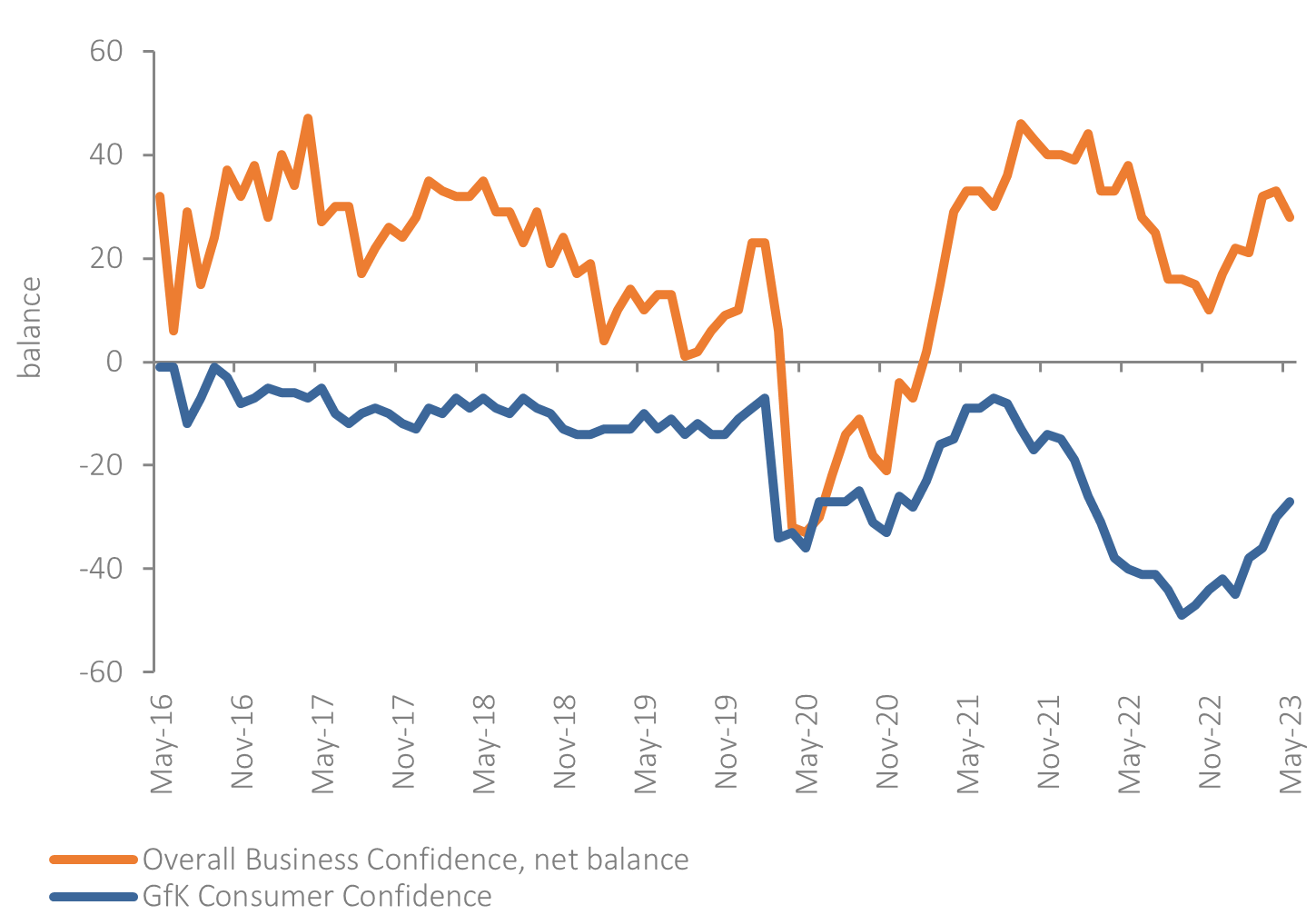

Fig 1: UK consumer confidence increased in May while business confidence fell

Source: GfK, Lloyds

Consumer confidence edged up three points to -27 in May (GfK), driven by strong earnings growth as well as extended government support with energy bills.

However, confidence measures ultimately remain negative, and the impact of changes to consumer confidence on spending typically lags by around three to six months. The effects of critically low confidence levels reported for Q4 2022 are thus still being felt.

Consumers seek value amid high food prices

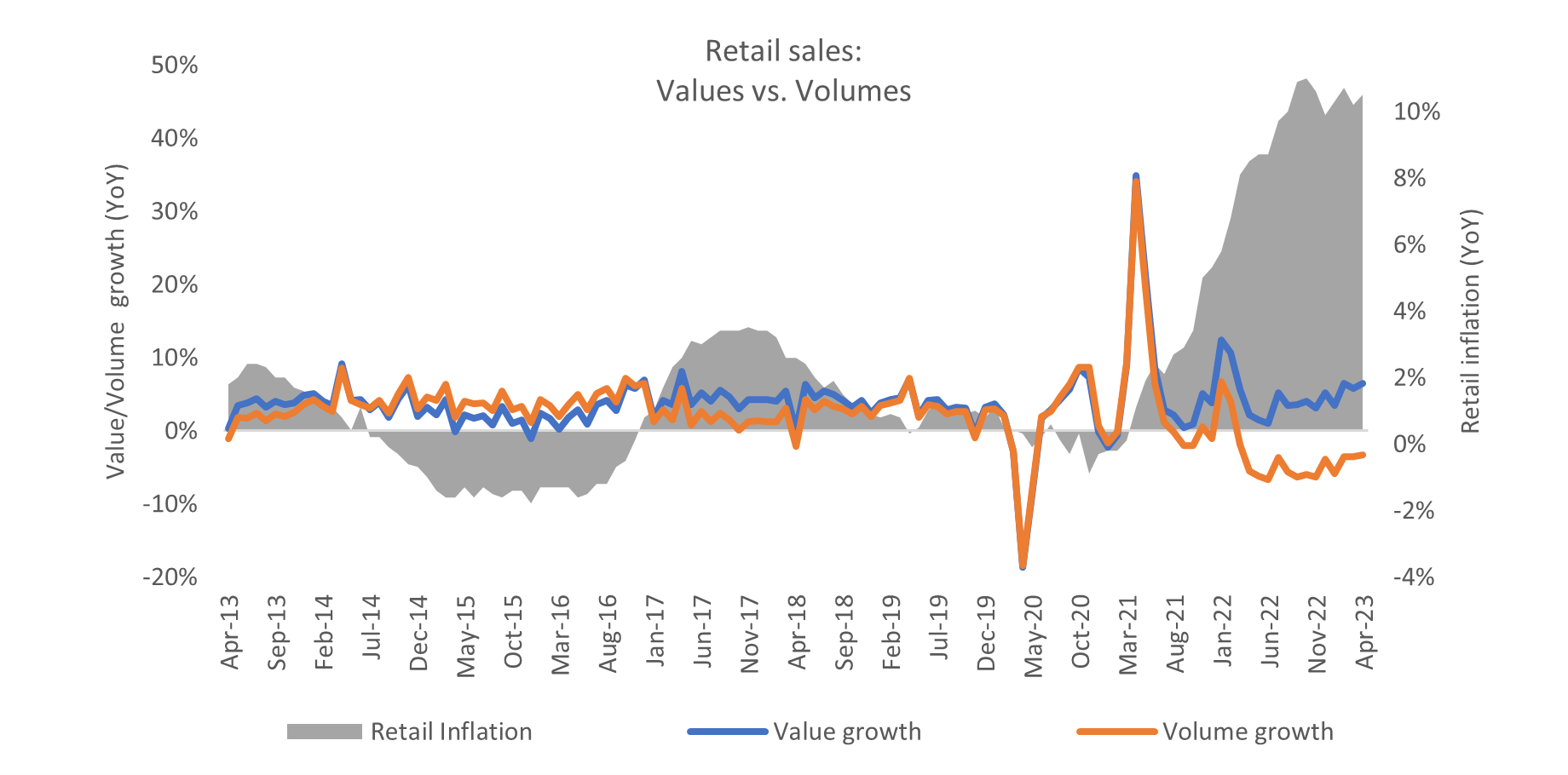

Retail sales increased 5.6% YoY in April (Retail Economics). However, when double-digit inflation is factored in, it points to the fourteenth consecutive month of declining sales values (Fig 2).

Food inflation remains critically high, at 19.0% YoY (April), putting further pressure on discretionary incomes.

Fig 2: Retail sales value and volume growth have detached due to high inflation

Source: ONS, Retail Economics analysis

While the four-day long Easter weekend supported sales of food and gardening products, overall demand remained subdued. April was the wettest and dullest for five years, making shoppers reluctant to spend on new spring and summer ranges.

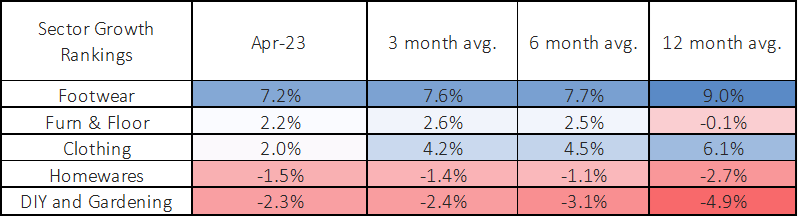

Fig 4: April 2023 retail sales by sector

Source: Retail Economics Retail Sales Index (value, non-seasonally adjusted).

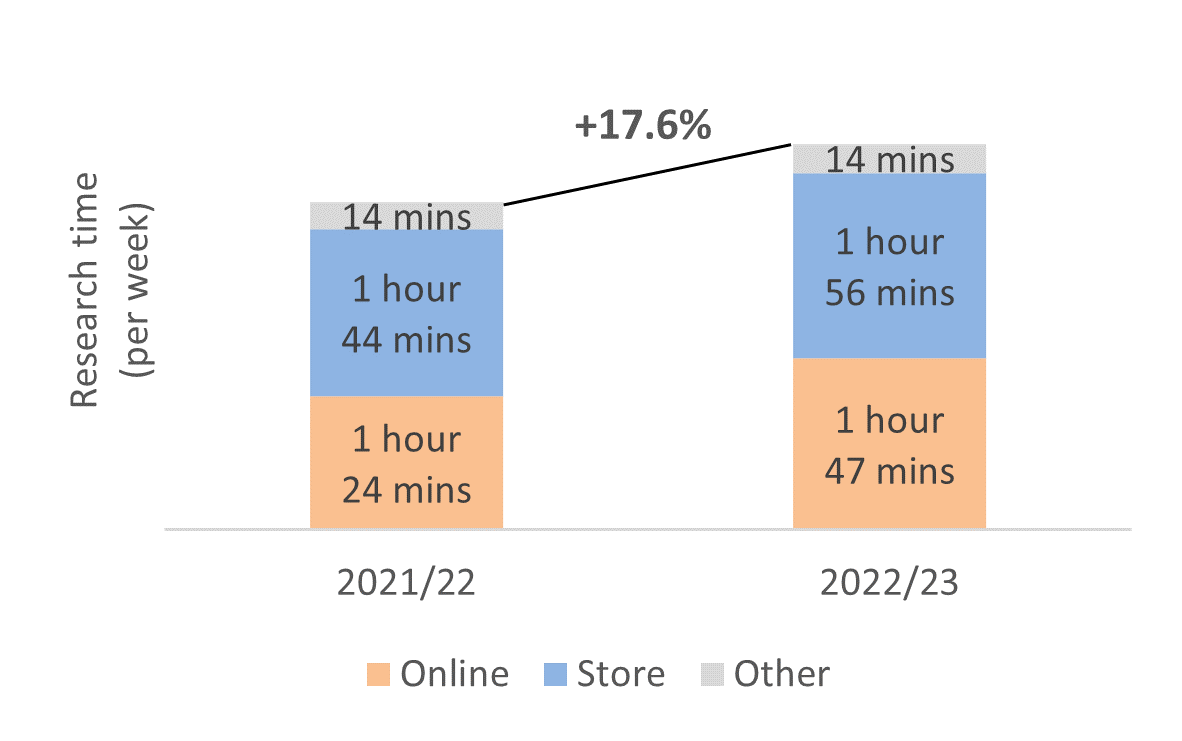

Customer journeys are becoming more considered amidst cost-of-living pressures, with shoppers putting intense focus on value. Retail Economics research found more than a third of shoppers increased the amount of time they spend investigating items in the past year before purchasing. On average, consumers now spend four hours per week researching, price comparing, and finding the best deals for non-food products across digital and physical channels (Fig 3).

Fig 3: Average non-food browsing time before buying products has stepped up on last year

Source: Retail Economics, FreedomPay

Industry Trends & Developments

Profitability pressures

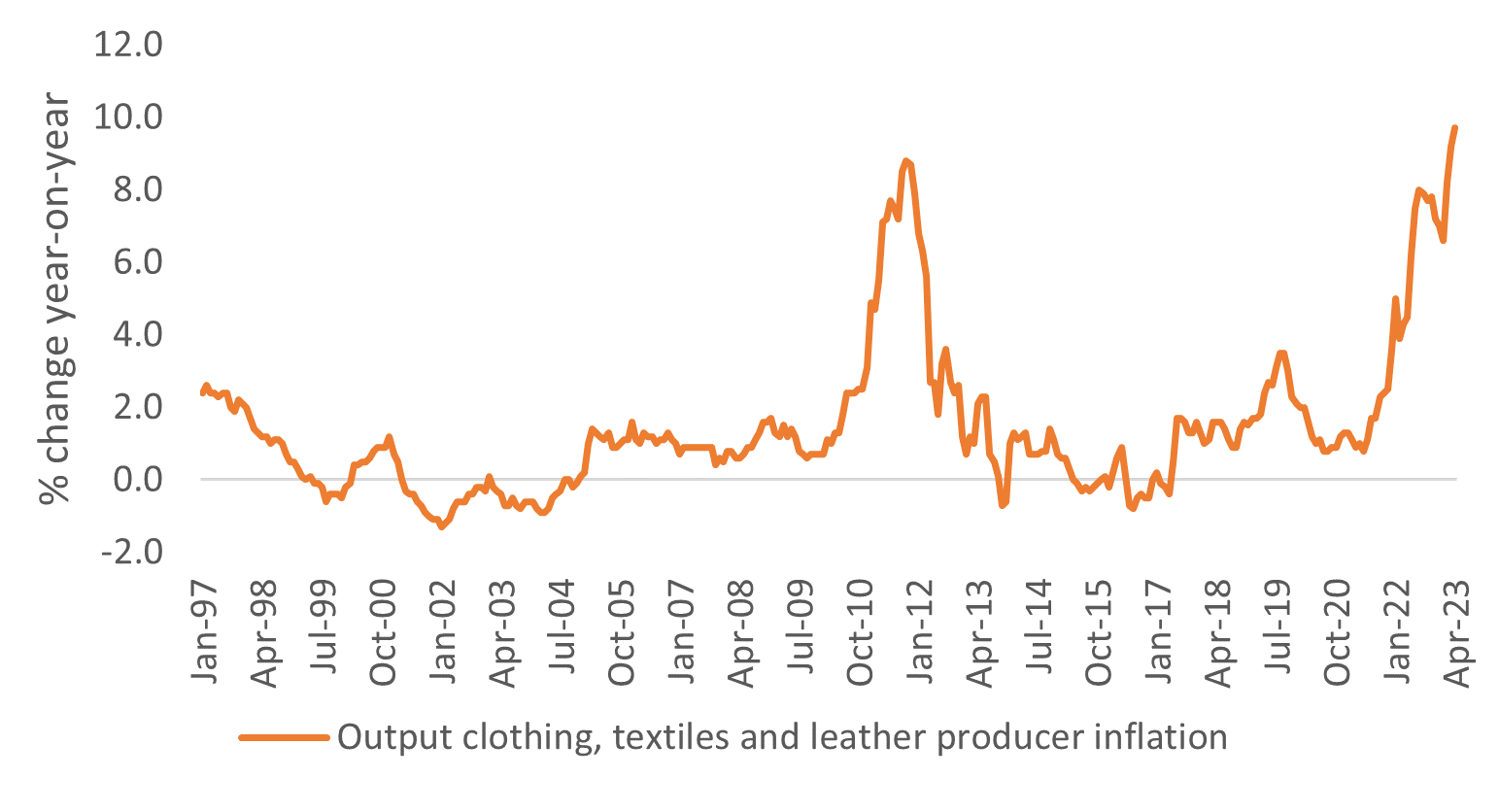

April saw output inflation among clothing producers (change in the prices of products as they leave the factory gate, before being sent to retailers) increase by 9.7% YoY, pointing to severe pressure on profitability, which is ultimately passed on to consumers.

Fig 5: Clothing factory gates prices rise at a record rate in April

Source: ONS, Retail Economics analysis

This has seen retailers and brands predicated on low prices and high volumes struggle, with online pureplays hit particularly hard as shoppers return to stores to avoid delivery/return fees. Boohoo’s adjusted EBITDA fell 49% in the period to £63.3m in the year to 28 February 2023. Meanwhile Asos recorded an adjusted pre-tax loss of £87.4m in the six months to February, down from a profit of £14.8m in the previous year.

Power of the weather

An unusually wet Spring disrupted seasonal purchase patterns, particularly for gardening products. However, the weather has improved in recent weeks, with sunshine and three public holidays raising growth prospects.

Homebase saw particularly high sales of plants and barbecues over the May Bank Holiday weekend. The retailer recorded a 20% YoY rise in sales of plants and a 12%YoY rise in sales of outdoor storage, while also selling over 22,000 barbecues.

Sustainability meets value

Research by eBay found that 14% of consumers are buying more second-hand furniture than a year ago. Affordability was the top reason for choosing second-hand furniture, with sustainability being the second most important motivator.

The online marketplace launched its new ‘Better Than New Homeware’ hub in May, allowing customers to browse and purchase affordable, pre-loved household goods, with vintage, refurbished and repaired products on offer.

About Retail Economics

Retail Economics is an independent economics research consultancy focusing exclusively on the retail and consumer industry. Our research and membership service empowers organisations with a deeper understanding of the key economic drivers supporting the retail industry, providing a competitive edge needed to make critical business and investment decisions.

Please contact us for information regarding our services:

T: 44 (0)20 3633 3698, W: retaileconomics.co.uk, E: amy.yates@retaileconomics.co.uk,

S: linkedin.com/company/retail-economics